This Panui we features among some rumbling what we think is an interesting perspective on no going back to the old economy by Rob Campbell.

Rob is an experienced company director and chair of Tourism Holdings, SkyCity Entertainment and Summerset Group. He’s involved in a small charity in South Auckland that is handing out thousands and thousands of dollars every day to people who are in financial distress through this particular circumstance. Rob is a former trade unionist with a Master of Philosophy in economics, he says “there’s no-one more socialist than a businessman who has had his business go bad”. You can read the full unabridged version here.

We tend to agree with what Rob is saying and know that any Government stimulus package will be pounced upon by a gaggle of organisations such as ‘big boy’ business, iwi sycophants with pie in the sky ‘jobs for our people’ and councils wanting to make their town look nice through widening footpaths and putting in another roundabout.

The Provincial Growth Fund (PGF) is a case in point with its mantra of we want ‘shovel ready projects’ which is really a call for the same old same old to toddle up to the Beehive to see Jonesy and stroke Matua Shane’s ego with have we got a deal for you. They’ll be saying we’ve got infrastructure, more trees to be planted (sorry these are pine not native, but they’re trees), and more conference centres. We can create more low value jobs with no future and no idea how to stimulate people’s curiosity, motivation, enthusiasm and commitment as long as we stick to the old economy way of doing things, and by the way, please sir can we have some more pūtea matua. Yay I just love getting up each morning to go out and plant trees and live under a cloud of uncertainty as to whether I’ll have work next week while anxiety builds up as to how I’m going to pay the bills and put kai on the table for the whānau…..we all know where that can lead and the suffering that follows.

Can’t we have say a mini type version of PGF like the ‘Entrepreneur & Small Business Fund’. This would enable entrepreneurs, creative and innovative thinkers as well as small businesses to rock up to pitch their projects to a panel of guess what…..Yes a panel of experienced ‘Entrepreneurs & Small Business’ people, devoid of bureaucrats and mandarins who hold fast to the policy manual of ‘How to say no in 10,000 different Ways’. This could all be done in a new economy way without having to write a book as part of the application process.

And yes granted some small businesses have been able to access the PGF but not before undergoing the Kiwi version of the Spanish Inquisition in front of a bunch of people that have never been in business…..give us a break please!! All this for being able to squeeze a small drop of blood from the PGF stone. Entrepreneurs and small business have far more challenges in front of them like securing customers and creating employment and being awesome at what they do without having to spend an inordinate amount of time to satisfy a tick box exercise. And yes we also get that there has to be prudence and due process followed but also question is that really being followed by the powers that be?

Anyway we’ve digressed enough but we also like this. Kiwibank chief economist, Jarrod Kerr says New Zealanders should each be given a payment of $1500 to stimulate the economy. He said New Zealand would re-enter a new world after the lockdown. One way to put a “Firestarter” under the economy was to direct more money back into New Zealanders’ hands.

That could be done with tax breaks – getting rid of GST for a period or reducing its rate – or by giving cash to people.

Kerr said he was living in Australia in 2009 when the government sent A$900 bonus cheques to Australians to help save the economy after the global financial crisis.

“I’d say a good $1500 per adult and $500 per child would cover a few months of bills for struggling households,” Kerr said.

That would mean a household of two adults and two children would receive $4000 and a single parent with three kids would get $3000.

“Some families will cover costs. Some will go shopping. Some will save it. It all helps.”

We say hallelujah to that…..final comment, we’ve noticed that a number of well-known and large profitable businesses were among the first to jump in on the Government’s wage subsidy…..just saying…..

and now onto Rob’s kōrero.

No going back to the old economy so be careful how you spend taxpayer cash

By Andrea Fox, nzherald.co.nz (Abridged version)

The honeypot of COVID-19 Government cash could be tempting companies to make distorted and value-destroying decisions in a misguided rush to recreate the “old” economy, warns business leader Rob Campbell.

He says he’d prefer most of that taxpayer-funded honey go to supporting businesses and families at “the bottom of the pile” rather than infrastructure building under some trickle-down economic theory.

“Most of the pain of the lockdown and the transition out of lockdown will be felt by people at the bottom of the pile socially and economically,” says Campbell.

“The theory that’s being applied – ‘let’s build infrastructure, let’s give money to this business and that business’ – is really just another version of the old trickle-down theory which is, you give money at the top and it will eventually trickle down to people at the bottom and they will be better off.

“It takes a long time to get to the people really hurting and I think we should be reversing that.

“When you think about it, the more you support those families, first, it is a human thing to do, but secondly, it gives them the purchasing power to decide what they want to spend it on and will provide businesses which are servicing their needs with the income they need to recover.”

Campbell says that when a big shock strikes, there’s a natural desire to want everything to go back to the way it was.

There’s also a tendency to want to “throw a lot of money at the recovery to pump up the engine quickly”.

“I think there are dangers in that and that it makes sense for us to constrain some of that natural impulse and not throw caution and judgment and risk management out the window.”

Many businesses, large and small, would fail. Some might have failed anyway, while others were already earning less than their cost of capital and were destroying value instead of creating it, he says.

“One of the problems with Government money is that it always feels like other people’s money, doesn’t it? At the end of the day it’s ours or at least future generations’, who will have to pay it back in some way. We ought to be just as cautious with that money as we would be in our own businesses.

“If you give cheap or free Government money to enable businesses to continue, in doing so you may be destroying the very thing that is valuable in business, which is the ability to evaluate risks and to take risk where the benefits that flow are greater than the costs.

“So I’m suspicious and concerned about the view that when we come out of this lockdown we need to start up quickly in exactly the same form we were before, with a big injection of Government money to help us get under way.

“I think that is as likely to cause problems as it is to solve them.”

“The hand goes out to Government pretty quickly.”

A number of businesses he is associated with are effectively closed and their leaders are planning for re-opening.

They’re not looking to recreate what they were, he says.

“We’re looking at what is going to work for the business and our various stakeholders in the future.

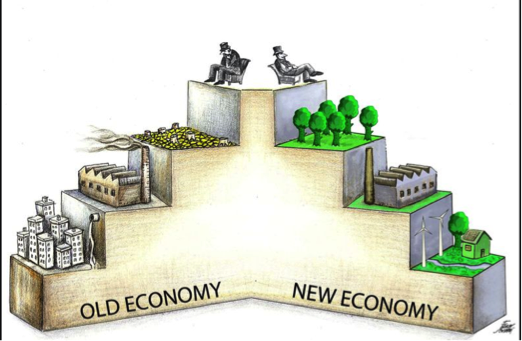

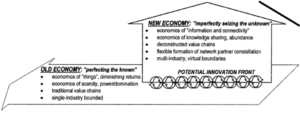

“So I think when the Government is spending money, it’s got to be very careful it doesn’t allocate money to projects that are of the old economy and not the new economy.”

Investment in new energy projects would be much more appropriate than in “old energy”.

The fight against climate change isn’t over, he says, it’s just been parked.

The “housing crisis” had to be questioned, with migration-driven population growth falling away, though there was still a big housing issue for people on low incomes.

“There’s an interesting issue as to whether building roads and bridges is necessarily the most effective way to transition New Zealand to the sort of economy it needs in the future.

“In this rush to get the economy restarted and have the Government make everything come right and the pain go away, there’s a danger you throw those judgments out the window.

“A business can’t afford to do that so the Government shouldn’t do it.”

In a LinkedIn post urging a “measured and moderate” response to the release from lockdown, Campbell said health officials and politicians would decide when it ended, but it would be businesses, large and small, which made the decisions about what to do next and how.

“It’s OK for various cheerleaders to advocate innovation and revival but the decision whether to restart, in what form and with what energy, is not about mood but about risk,” he wrote.

Campbell thinks the Government is aware of the risks of a wasteful use of resources and the potential for long-term damage if businesses make rushed or rash decisions.

“But it’s under pressure from just about every quarter to give them money to sustain their current business model.

“My view about the simple economic impact of that, is that it lowers the cost of capital for those businesses and that will lead to investment which does not meet the genuine cost of capital…..the genuine risk of operating whatever business that may be.

“When you distort that, you inevitably create decisions that destroy value rather than create value.

“It’s simple economics but people lose sight of that when they think there is a honeypot with honey being distributed out of it.”

Campbell says benefit levels are “manifestly inadequate” and more Government spending should be focused there.

“I’d be spending more money on the health and social services needed to wrap around these people.

“I think that’s frankly more important than whether liquor stores open tomorrow.”

What does the “new economy” look like for Tourism Holdings?

A lot of mergers and acquisitions are ahead for the New Zealand tourism sector in the fallout from COVID-19, says Tourism Holdings chairman Rob Campbell.

The NZX-listed company, the biggest renter and seller of holiday vehicles in the world, is a major casualty of the virus crisis and will be a keen participant in the merger and buying activity, he says.

Campbell is confident Tourism Holdings will get through the crisis – but says it isn’t expecting to recreate itself as it was.

“It would be foolish for us to be saying to ourselves, or to anyone else, ‘give us some [Government] money and we’ll make things like they were before’. Because they’re not going to be like they were. No matter how much money we get.”

Border closures and community lockdowns in New Zealand and in Tourism Holdings’ overseas markets have effectively shut down the business, while threatening the jobs of 100,000 of the country’s 400,000 tourism workforce and carving at least $12 billion off the sector’s expected income in the next six months.

Tourism Holdings’ share price has slumped, Campbell and his directors are taking a 30 per cent drop in fees, and chief executive Grant Webster a 50 per cent hit to his salary, for four months. Meanwhile, the company’s big fleet of motorhomes has been made available for emergency quarantine and housing, and use by emergency services.

Campbell says the company appreciates the Government’s wage subsidy support to keep staff.

“It may be there is a case for some Government money to assist the tourism industry to transition – in the trade that’s being called ‘Tourism 2.0’ so it’s being actively discussed among tourism businesses what tourism will look like, and there’s acceptance it’s not going to be like it was.

“Tourism 2.0 for us will involve a much smaller business in terms of our motorhomes in New Zealand and other countries where we operate.

“We think we will have to re-orient our investment to other tourism activities once we work our way through this process. We are still doing the work, not just internally but with other tourism operators, to work out what that might look like.

“I think there will be a lot of merger and acquisition activity in tourism which we will be keen to participate in. We’ve got to get through the height of the storm which is still blowing pretty hard around us, but we will get through it.

“We have a strong balance sheet and our team is very capable. We’ll get through it and play a different role in tourism, but there won’t be anything like the number of motorhomes driving around the country like we’ve had in the past.

“That’s just a fact. We have to accept it quickly and work out what’s better than that.”